Thinking about building a steel facility but worried about the cost?

Or maybe you’re asking: Will the investment really pay off?

Steel industrial buildings are popular because they’re fast, durable, and efficient.

But here’s the key: understanding true costs and ROI potential can make or break your project.

This guide shows you the numbers, the hidden factors, and the strategies that turn a steel building from an expense into a profit engine.

Understanding the Cost of a Steel Industrial Building

Steel industrial buildings are popular in Canada because they balance durability, speed, and cost efficiency. But before you commit, you need to know the real numbers, not just the price of a shell, but the full scope of what makes up your investment.

Average Cost Per Square Foot

In Canada, here’s what you can expect to pay in 2025:

| Type / Scope | Approx. Cost per Sq. Ft. (CAD) | What’s Included |

| Basic steel shell / prefab kit | $20 – $30 | Frame, roof, siding. No foundation, insulation, or utilities. |

| Standard industrial building | $30 – $45 | Structure, siding, roof, basic insulation. Climate loads (snow/wind) raise price. |

| Turnkey / finished building | $45 – $70+ | Adds foundation, utilities, doors, windows, HVAC, and finishes. |

Larger projects spread fixed costs over more square feet, often lowering the average rate. Small or highly customized builds run higher per foot.

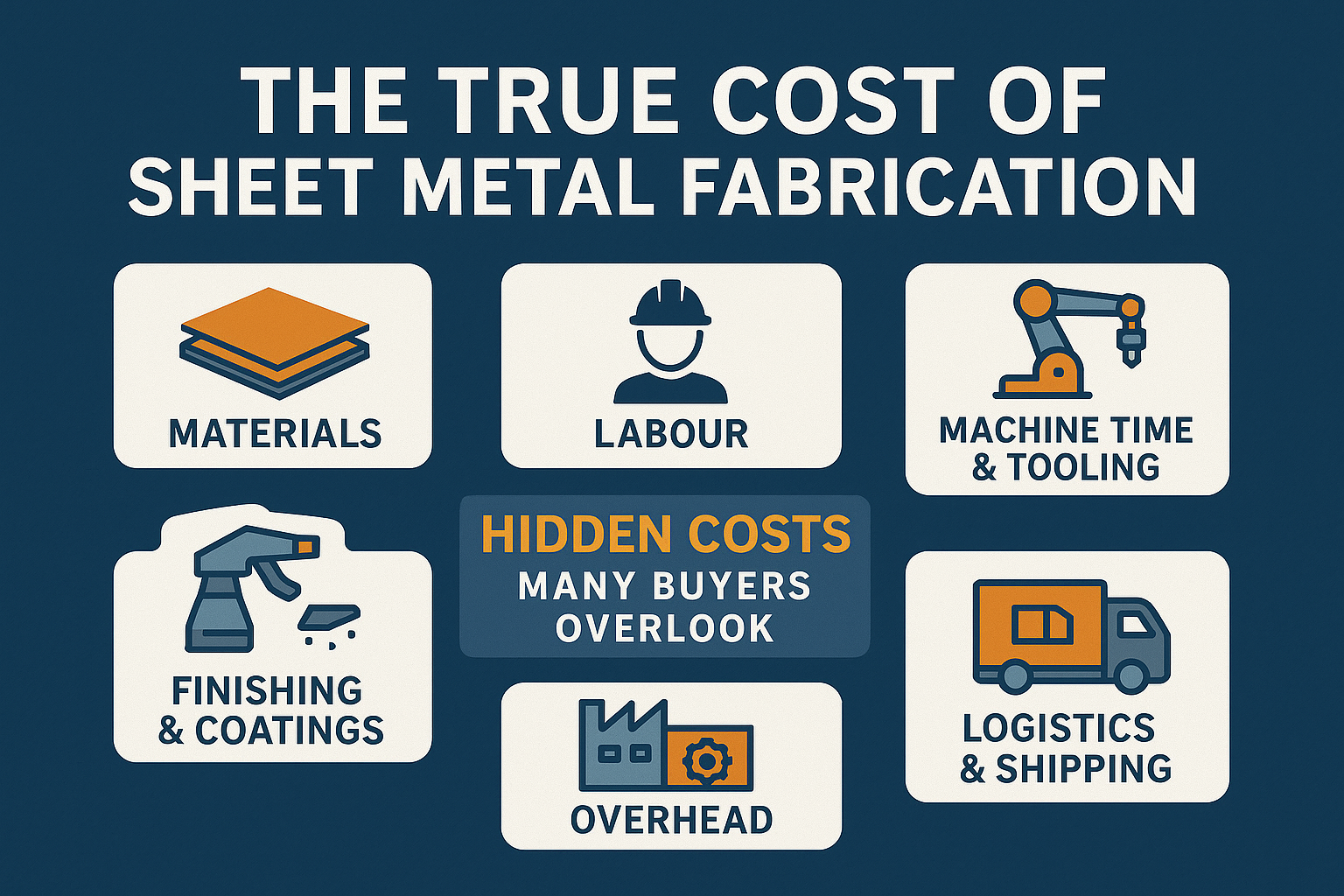

Where Your Money Goes

Steel building costs aren’t just about steel. Here’s the breakdown:

- Materials: The shell (frame, panels, roof, siding). Steel price swings affect this most.

- Labour / Assembly: Construction crews, welding, bolting, installation. Costs rise in metro areas or remote sites.

- Foundation & Site Prep: Excavation, soil work, concrete slab, grading. Unstable soil can double this line item.

- Insulation & Finishes: Doors, windows, HVAC, lighting, interior partitions. Critical for comfort and code compliance in Canadian winters.

- Permits & Compliance: Municipal approvals, engineering, and inspections. A must, but often underestimated.

- Transport & Logistics: Delivering steel kits across provinces, plus crane rental and handling on site.

Hidden Costs Canadian Owners Often Miss

- Snow & Wind Loads: Buildings in Ontario, Quebec, or the Prairies need stronger frames. Adds structural cost.

- Climate Efficiency: Energy codes demand better insulation and heating systems. Upfront costs → long-term savings.

- Permitting Delays: Larger cities like Toronto or Vancouver have stricter rules. Factor in both money and time.

- Tariffs & Steel Supply: Global steel price volatility and import costs affect Canadian buyers more than U.S. buyers.

- Remote Site Premiums: Transporting materials to rural or northern areas inflates freight and labour costs.

Bottom line: In Canada, a realistic all-in steel industrial building budget falls between $30 and $60 per square foot, depending on size, finish, and region. The key is knowing which costs are essential and which are avoidable surprises.

Factors That Influence Building Costs

Many decisions affect what your steel industrial building will cost. Understanding these cost drivers helps you budget better and avoid surprises. Below are key factors with Canadian context.

1. Size & Complexity of the Building

- Scale matters: Larger buildings spread out fixed costs (like engineering, permits, delivery). So cost per square foot often drops as size increases.

- Height, span, roof shape: Taller walls, wider clear spans, steeper roof pitches require more steel, stronger frames, possibly different framing systems. All of this raises cost.

- Internal complexity: Mezzanines, overhead cranes, heavy machinery foundations, multiple floors will push up material and labor costs.

2. Geographic Location & Climate

- Snow loads, wind loads, seismic codes: In Canada, northern regions, mountain regions, or coastal areas have stricter structural requirements. More snow or extreme wind means stronger framing, thicker panels, more cost.

- Remote vs urban: Access to suppliers and skilled labor. Remote sites cost more for freight, labour mobilization, possibly site preparation.

- Provincial building codes: Different municipalities enforce different standards (insulation value, energy performance, fire resistance). These add design and material cost.

3. Design Customization & Add-Ons

- Insulation and energy efficiency: Higher R-value insulation, triple-glazed windows, efficient heating/cooling, better doors cost more initially but help with long-term savings. Canadian winters make these essential in many regions.

- Special features: Mezzanines, large roll-up doors, custom windows, skylights, specialized coatings (for corrosion, fireproofing) all add cost.

- Finish quality: Interior finishes, architectural touches, optional aesthetics versus purely functional build. Each upgrade adds labor and material complexity.

4. Labour Market Conditions

- Skilled labour shortage: Canada has reported labour shortages in the construction sector. This raises wages, slows project timelines, and raises risk of delays.

- Regional labour cost variance: Urban centres (e.g. GTA, Vancouver, Calgary) tend to have higher wages. Remote or rural areas may need to bring in specialized labour at cost.

- Seasonality: Winter construction in very cold or snowy months may require special scheduling, heating, or snow/ice handling, which increases cost. While not always explicitly listed, climate factors tie into labour and site prep in Canadian sources.

5. Material & Steel Market Fluctuations

- Steel commodity cost: Steel prices fluctuate globally and locally due to supply chain, raw material costs (iron ore, energy), tariffs/trade policy. This directly scales up material cost.

- Cladding, coatings, thickness: Heavier steel gauge, better protective coatings, or specialty siding (like insulated wall panels) all cost more.

6. Logistics, Delivery & Site Preparation

- Transport and delivery: Moving steel kits from mill to your site, crane access, truck fees. Remote or difficult terrain increases these costs.

- Foundation & soil work: If soil is poor, sloped, or requires extra drainage, costs rise. Site leveling, geotechnical tests, reinforced foundations needed.

- Permits, inspections & regulatory compliance: Municipal permit fees, engineering drawing fees, building inspections, energy/performance or environmental assessments. Delays or oversights cost money.

ROI of Steel Industrial Buildings

Steel pays back in ways owners feel quickly and for decades.

1) Faster build → earlier revenue

Pre-engineered metal buildings (PEMBs) can trim schedules by ~30–40% versus conventional systems like tilt/precast. That means rent starts sooner and downtime shrinks.

2) Lower maintenance & predictable lifecycle costs

Steel systems avoid many moisture, pest, and rot issues that plague other envelopes. Durable coatings and standardized components make upkeep simpler and more predictable across Canadian climates. Industry comparisons also show steel structures competing favorably on lifecycle cost versus alternatives when maintenance is included.

3) Energy efficiency that compounds each year

Insulated metal panels (IMPs) deliver high thermal performance (closed-cell cores with high R-per-inch values), cutting heating loads in cold provinces and cooling loads in summer. Case examples in Canada show IMPs integrated with other efficiency measures to lower operational energy for decades.

4) Speed + envelope choices reduce total installed cost

Thoughtful envelope selection (e.g., modern IMPs) can reduce installed wall costs while also lowering embodied carbon, helpful for budgets and ESG goals. Faster enclosure shortens the critical path and reduces general conditions.

5) Flexibility to expand, reconfigure, or relocate

Steel industrial buildings are inherently modular. Clear spans, standardized bays, and bolt-up frames make it easier to add bays, add a mezzanine, or re-skin façades as needs change protecting long-term value and resale.

6) Resale value in active markets

Canadian industrial demand has been strong, especially in logistics hubs. Faster delivery and adaptable layouts help preserve asset value as tenant needs evolve. (Market context: 2024–2025 reports highlight brisk industrial activity in Ontario.)

What this means for ROI

- Revenue starts sooner (schedule advantage).

- Operating costs drop (energy + maintenance).

- Capex stays efficient (optimized envelope + modular upgrades).

- Exit values hold (marketable, adaptable shell).

Steel vs. Traditional Construction ROI Comparison

When you build, the real comparison isn’t just who’s cheaper now it’s who wins in value over time. This section shows how steel and traditional materials stack up on ROI, with data and insights you’ll care about.

What the Studies Show

- A Canadian report found steel framing made whole-building cost about 9-10% lower compared to concrete for similar structures when you include foundations, schedules, maintenance, and energy. Costs that seem higher up front tend to get offset.

- Another analysis said steel buildings cost less to maintain over 20 years. Energy use drops by about 10-20%, and resale (or adaptability) adds value because steel lets you modify or expand more easily.

- Comparisons done in Canadian commercial settings show steel options often require lighter foundations. Lighter foundation reduces cost of excavation, materials, labour. That savings shows up early.

Key ROI Advantage Areas

Here are the main areas where steel typically beats traditional construction in terms of return:

| Factor | Steel Advantage | Why It Matters for ROI |

| Construction Speed | Steel components are prefabricated. On-site erection takes less time than many concrete or masonry builds. | Faster completion → earlier operations, earlier revenue, less financing cost. |

| Lower Foundation & Structural Costs | Because steel is lighter, the structural load is often less. Foundations can be smaller. | Saves on concrete, excavation, labour, materials. Immediate savings. |

| Energy & Maintenance Savings | Steel with good insulation, tight joints, modern panels; fewer issues with rot, pest, water intrusion. | Lower heating/cooling bills, fewer repair works over years. Adds up. |

| Flexibility & Adaptability | Open spans, modular design, easier to add or remove sections, change usage. | Boosts resale value / re-use possibilities; can avoid full rebuilds. |

| Durability & Lifespan | Steel resists mold, pests, and many environmental problems that degrade traditional materials faster. | Longer useful life yields more years of revenue or usefulness. |

Typical ROI Timeframes

Here’s what you can expect in Canadian settings, roughly:

- Payback Period: 5-10 years is a realistic goal, if you plan carefully (good design, moderate finishes, efficient utilities).

- Lifespan Beyond Payback: After the payback period, you’ll see years of lower operating costs, less downtime for maintenance, and possibly income from leasing or resale.

- Resale/Adaptation Value: Properties that stay useful, adaptable, and compliant with building code changes tend to retain value. Steel’s flexibility helps here.

Risks & When Traditional May Be Better

Steel isn’t always automatically the win. Watch out for:

- When your design has very low square footage and very simple structure it may be cheaper to use masonry, wood, or concrete for simple builds.

- Where local labour for steel erection is very expensive or limited transport + labour can erase advantages.

- If extreme insulation or finishes are needed (e.g. extremely cold zones, high fire or sound ratings), the cost of specialty panels, coatings, etc., can push steel costs up significantly.

- In jurisdictions with very strict aesthetics or heritage rules that favour traditional styles, steel may require extra cladding or modifications, which add cost.

Bottom Line ROI Comparison

Steel tends to offer higher ROI in most industrial building projects in Canada when you consider:

- Faster launch of operations

- Savings on foundation and structure

- Reduced maintenance & energy costs

- Ability to adapt or expand

If you plan well around use, design, and maintenance, steel often outperforms traditional materials over a 10- to 20-year time horizon.

Real-World Scenarios and Case Studies

Let’s look at real buildings, their costs, and how fast they paid off. These stories show what happens when theory meets the real world.

Case Study: Warehouse in Calgary — Steel vs Tilt-Up Concrete

A 75,000 square foot e-commerce fulfillment center in Northeast Calgary was recently built using steel. The cost came to about $92 per square foot.

For similar size and requirements, a tilt-up concrete version would likely cost more per square foot and take longer to complete (due to curing time and complexity). This means steel offered both savings in time and lower indirect costs during construction delays.

Breakdown: Payback Period & Savings Timeline

Here’s how ROI often plays out in these types of Canadian projects:

| Project | Size / Type | Estimated Upfront Cost per sq ft | Savings Areas | Estimated Payback Period |

| Calgary warehouse (steel) | 75,000 sq ft facility | ~ $92 / sq ft | Faster build, lower foundation cost, shorter construction schedule, fewer delays | Likely 5-8 years, depending on energy savings and usage intensity. (Steel option benefits most in schedule) |

| Generic 10,000 sq ft steel vs traditional comparison | Commercial/industrial shell | Steel material + energy + maintenance vs traditional | Energy savings (~10-20%), reduced maintenance cost (~half or less) | Usually 7-10 years depending on climate, usage, finishes. (Based on long-term cost curves) |

What To Learn From These Examples

- Size matters: Big buildings spread fixed costs better; small builds sometimes don’t get as big advantage. The Calgary example is large, so steel’s benefits show more clearly.

- Usage intensity: The more you use the building (lots of hours, heating/cooling usage, heavy loads), the faster savings from energy and maintenance kick in.

- Climate & location: Cold winters or locations needing heavy snow/wind design increase initial cost, but also increase energy/maintenance savings in the long term.

- Finish level & utilities: If you plan to heavily finish (offices, HVAC, high partitions), savings from just steel structure diminish a bit; need to do full cost vs benefit of finishes.

Financing and Incentives

Here’s a deeply researched section on how you can finance a steel industrial building in Canada, and what tax incentives / grants are available. This will help you plan funding, reduce costs, and improve ROI.

Financing Options

- Commercial & Construction Loans

You can get a construction loan (to build) which converts into a term loan after completion. Traditional banks and credit unions offer these. The rate depends on region, business credit, and equity you can put in. - Independent / Alternative Lenders

If banks require too much, you might try independent financiers or brokers. They may offer more flexible terms, though at somewhat higher cost. - Payment Plans / In-House Financing

Some builders or suppliers allow staged payments tied to construction phases (foundation, framing, cladding, etc.). This smooths cash flow. - Grants & Government Programs

There are federal and provincial grants, plus special programs for green building, energy efficiency, and industrial modernization. These reduce upfront cost or offer cost‐sharing. See below.

Key Incentives, Subsidies & Tax Advantages

Here are specific programs and policies you can use to reduce cost or get financial relief.

| Incentive / Program | What It Offers | How It Helps Industrial Steel Buildings |

| Green Industrial Facilities & Manufacturing Program (GIFMP) | Non-repayable funding from NRCan; up to $5 million per project; supports energy efficiency, energy management, GHG reductions. Projects must be finished by a deadline. | Helps finance sustainable components (insulation, efficient HVAC, monitoring systems, etc.). Reduces energy costs and improves long-term ROI. |

| Capital Cost Allowance (CCA) | Depreciation rules for business property. Buildings and eligible equipment can be depreciated over time (declining balance). Specific CCA classes apply. | You can deduct cost of the building or parts over several years. That improves tax cash flow, effectively reducing net cost. |

| Clean Economy / Investment Tax Credits | Refundable investment tax credits (ITCs) of 30-60% for eligible clean technology, renewable energy, or energy efficiency projects. | If your building includes clean tech, energy-saving measures, or low carbon systems, these credits can offset a large portion of cost. |

| Regional / Municipal Grants or Subsidies | Local programs like the Sustainable Industrial Buildings Program in Montréal. Offers property tax increases subsidies; support if building meets sustainable standards. | Local relief on taxes or grants for sustainable or green certified builds helps reduce yearly operating costs or upfront cost. |

What to Factor Into Your Financing & Incentives Plan

- Verify eligibility early (region, size, use, ownership). Many grant programs require sustainability certification, measurable emissions reductions, or energy performance.

- Identify programs with application deadlines. Some funding pools expire or have tight windows. (e.g., GIFMP deadline is September 2025 for some tracks)

- Factor in matching funds / cost-sharing. Many grants do not cover 100 % of eligible costs. You may need to show you can finance the remainder. GIFMP provides cost-shared funding.

- Understand tax depreciation (CCA) schedules. The class your building or its components fall under determines what rate you can deduct, impacting cash flow and ROI.

- Coordinate between financing and incentives. For example, you might reduce the loan amount needed if large grants are successful; or you might target higher energy performance to qualify for tax credits.

How to Calculate ROI for Your Steel Industrial Building

Ready to see if your investment will truly pay off?

Here’s a simple way to calculate ROI and check how quickly your steel building can start returning value.

A. Quick ROI + Payback Formulas

-

Simple ROI (%)

ROI=(Annual Net Benefit / Total Project Cost )×100

“Annual Net Benefit” = energy savings + maintenance savings + added revenue − extra operating costs.

-

Simple Payback (years)

Payback=Total Project Cost / Annual Net Benefit

Use this to see how fast the project pays for itself.

- Pro Tip (advanced): Check NPV/IRR in a spreadsheet (NPV/XNPV, IRR/XIRR). It accounts for time value of money and uneven cash flows.

B. What to include in “Annual Net Benefit”

- Energy savings

Use your planned envelope (e.g., insulated metal panels) and local energy rates. IMPs can provide high R-values per inch, which lowers heating demand in Canadian winters.

To size the opportunity, benchmark against Canadian warehouse EUI medians in Portfolio Manager. - Maintenance savings

Steel buildings typically budget ~1–3% of initial cost per year for maintenance; traditional assemblies often run higher. Use the delta as “savings.” - Earlier revenue / avoided costs

Prefabrication and faster erection cut schedules. Earlier occupancy means earlier rent or production and fewer interim costs (e.g., off-site storage). - Tax effects

Factor CCA depreciation to estimate after-tax cash flow. Most non-residential buildings fall in Class 1 (base 4%). Eligible manufacturing/process buildings may claim enhanced rates (e.g., 6% or 10% with elections). Check current CRA tables. - Grants/credits

Subtract any approved incentives from your up-front cost (or treat as cash inflows). Federal programs for efficiency and clean tech can materially improve ROI.

C. 5-Step Mini Example (plug in your numbers)

- Total Project Cost: $3,000,000 (turnkey).

- Annual Energy Savings: $60,000 (IMPs + efficient HVAC vs baseline).

- Annual Maintenance Savings: $30,000 (steel at ~1–3% vs higher baseline).

- Earlier Revenue / Avoided Costs: $80,000 (schedule acceleration).

- Annual Net Benefit: $60k + $30k + $80k = $170,000

- Simple Payback: $3,000,000 / $170,000 ≈ 17.6 years

- ROI (Year 1): $170,000 / $3,000,000 × 100 ≈ 5.7%

- Next: Build a cash-flow table and compute IRR/NPV with your discount rate for a truer view.

(Your numbers may look stronger if the project is larger, energy prices are higher, or incentives reduce capex. Always localize inputs.)

D. ROI Checklist

- Project scope, size, and intended use are locked.

- Local EUI baseline and utility rates gathered.

- Envelope specs set (panel R-values, thermal breaks).

- Construction schedule vs traditional baseline estimated (months saved).

- Maintenance assumptions documented (steel vs alternative).

- CCA class and after-tax cash flow modeled.

- Grants/credits verified and applied.

- Sensitivity test (±10–20% on energy, schedule, and costs).

- IRR/NPV calculated to confirm payback and risk.

Your Next Step to a Smarter Steel Investment

Every dollar you put into an industrial building should work hard for you. Steel delivers that by lowering upfront costs, speeding up construction, and protecting your investment for decades. The smartest step now is to get a clear, customized estimate tailored to your project needs. At Metal Pro Buildings, we’ll walk you through costs, timelines, and ROI so you can move forward with confidence.

👉 Request your custom quote today and start building smarter, faster, and with greater returns.